Latest Version

Version

1.19-prod

1.19-prod

Update

May 17, 2025

May 17, 2025

Developer

Guaranteed Rate, Inc

Guaranteed Rate, Inc

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

com.guaranteedrate.superapp

com.guaranteedrate.superapp

Report

Report a Problem

Report a Problem

More About Rate: Mortgages, Loans & Refi

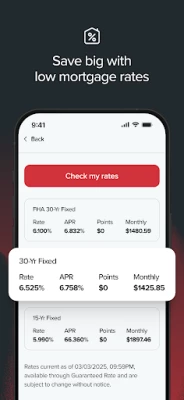

At Rate, we believe homeownership is the first step toward unlocking a better future for you and your loved ones. Buying a home is an exciting journey, but it can also be overwhelming. That’s why we offer not just mortgages, but access to free wellness resources to ease the stress and support you every step of the way. You are the reason we do what we do—the why behind our mission to provide not only the best mortgage experience but also a path to better well-being.

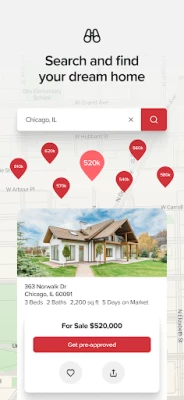

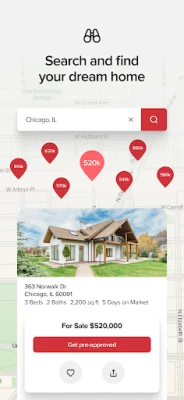

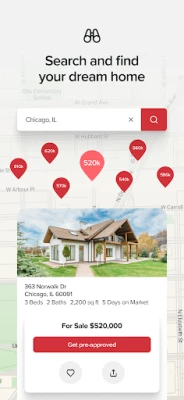

Find Your Dream Home

Browse MLS property listings with home search

Filter homes by location, price, amenities and more

Crunch the numbers with our free mortgage calculator

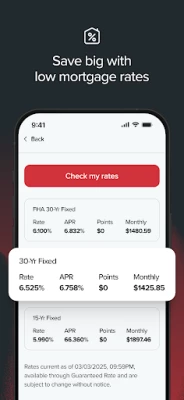

Apply for Home Loans

Apply for home loans, refinancing, or home equity loans and get approved in minutes

Easily upload documents, track your application progress, and receive real-time updates

Access your credit score once you apply for a loan

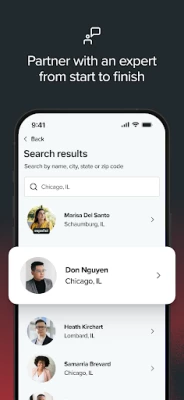

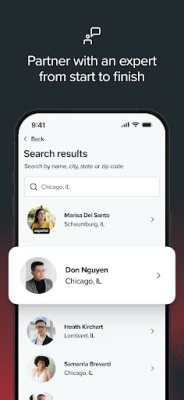

Access Loan Experts at Your Fingertips

Connect with loan officers ready to guide you through the homebuying journey

Receive personalized guidance to improve your financial future

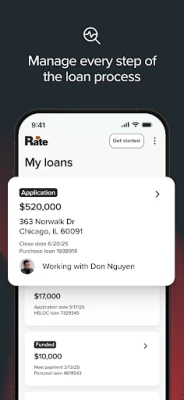

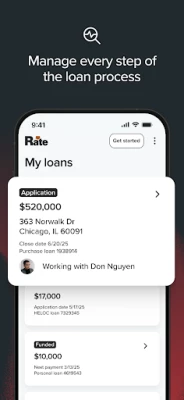

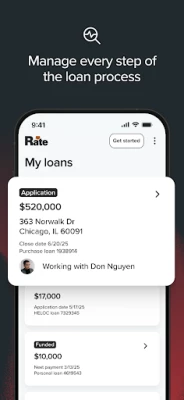

Manage Your Mortgage & Stay Informed

View key loan details such as balance, payment schedule, and more—all in one place

Make mortgage payments quickly and securely in our Loan Center

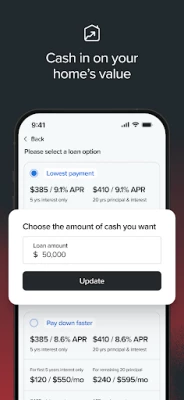

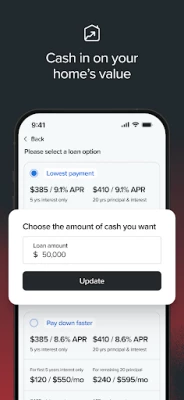

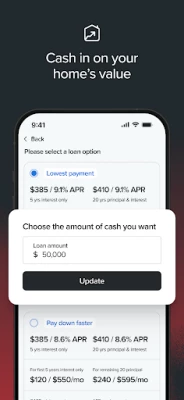

Make Your Home Equity Work for You

See your home value estimate

Apply for a HELOC or home equity loan

Monitor your home equity growth over time

Mortgage Mindfully with Rate

Access financial resources and content to guide you on your financial journey

Improve your wellbeing with expert-led challenges and collections spanning fitness, nutrition, yoga, mindfulness, and more

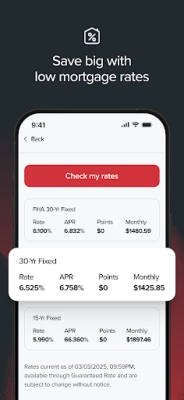

Refer to rate.com/personal-loans, rate.com/HELOC, and rate.com/home-valuation for important eligibility requirements and restrictions. Standard fixed rates from 9.99% to 21.99% APR. With a 0.25% autopay discount established at loan origination with an automated monthly debit from a qualifying deposit account for repayment, fixed rates range from 9.74% to 21.74% APR. Loan amounts range from $4,000 - $50,000 and are subject to state requirements. Loan proceeds cannot be used for post-secondary education expenses or to purchase cryptocurrency or securities.Not all products are available in all states. Refinancing your mortgage may increase costs over the term of your loan. Guaranteed Rate, Inc. d/b/a/ Rate (NMLS #2611) has financial interest in Rate Insurance, LLC. You are not required to use Rate Insurance. All applicants are subject to credit and underwriting approval and not app applicants will be approved. Talk to a Rate loan officer for more information. Go to www.nmlsconsumeraccess.org for licensing information.

Browse MLS property listings with home search

Filter homes by location, price, amenities and more

Crunch the numbers with our free mortgage calculator

Apply for Home Loans

Apply for home loans, refinancing, or home equity loans and get approved in minutes

Easily upload documents, track your application progress, and receive real-time updates

Access your credit score once you apply for a loan

Access Loan Experts at Your Fingertips

Connect with loan officers ready to guide you through the homebuying journey

Receive personalized guidance to improve your financial future

Manage Your Mortgage & Stay Informed

View key loan details such as balance, payment schedule, and more—all in one place

Make mortgage payments quickly and securely in our Loan Center

Make Your Home Equity Work for You

See your home value estimate

Apply for a HELOC or home equity loan

Monitor your home equity growth over time

Mortgage Mindfully with Rate

Access financial resources and content to guide you on your financial journey

Improve your wellbeing with expert-led challenges and collections spanning fitness, nutrition, yoga, mindfulness, and more

Refer to rate.com/personal-loans, rate.com/HELOC, and rate.com/home-valuation for important eligibility requirements and restrictions. Standard fixed rates from 9.99% to 21.99% APR. With a 0.25% autopay discount established at loan origination with an automated monthly debit from a qualifying deposit account for repayment, fixed rates range from 9.74% to 21.74% APR. Loan amounts range from $4,000 - $50,000 and are subject to state requirements. Loan proceeds cannot be used for post-secondary education expenses or to purchase cryptocurrency or securities.Not all products are available in all states. Refinancing your mortgage may increase costs over the term of your loan. Guaranteed Rate, Inc. d/b/a/ Rate (NMLS #2611) has financial interest in Rate Insurance, LLC. You are not required to use Rate Insurance. All applicants are subject to credit and underwriting approval and not app applicants will be approved. Talk to a Rate loan officer for more information. Go to www.nmlsconsumeraccess.org for licensing information.

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

Statastic Basketball TrackerStatastic Solutions FlexCo

Peacock TV: Stream TV & MoviesPeacock TV LLC

WPS Office-PDF,Word,Sheet,PPTWPS SOFTWARE PTE. LTD.

Mr.Billion: Idle Rich TycoonIDSIGames

TCG Card Store Simulator 3DBlingames

RealVNC Viewer: Remote DesktopRealVNC Limited

3D Chess GameA Trillion Games Ltd

Ludo King®Gametion

Meta Business SuiteMeta Platforms, Inc.

Duplicates Cleanerkaeros corps

More »

Editor's Choice

Grim Soul: Dark Survival RPGBrickworks Games Ltd

Craft of Survival - Gladiators101XP LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : WastelandStickyHands Inc.

AoD Vikings: Valhalla GameRoboBot Studio

Viking Clan: RagnarokKano Games

Vikings: War of ClansPlarium LLC

Asphalt 9: LegendsGameloft SE

Modern Tanks: War Tank GamesXDEVS LTD