Latest Version

Version

33.4.0

33.4.0

Update

August 12, 2025

August 12, 2025

Developer

SpecAppsForFinTech

SpecAppsForFinTech

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

com.jamstr.unic

com.jamstr.unic

Report

Report a Problem

Report a Problem

More About Instacash - Money Loan App

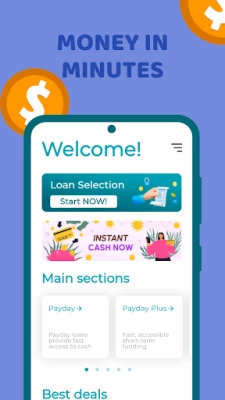

Hello! We are Introducing Lending Instacash App, your gateway to smarter payday financial solutions, including credit card management and instant loans. Whether you’re handling day-to-day expenses or seeking payday credit card offers, Instacash is here to simplify your financial journey instantly!

What Problems Can a Credit Card or Payday Loan Solve?

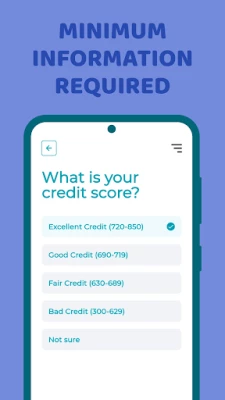

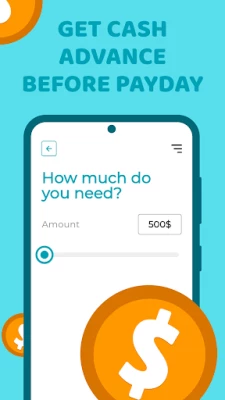

Do you need flexibility to manage unexpected expenses or a reliable way to build credit instantly? Instacash provides money to compare and apply for credit cards with features like cashback, low interest rates, and flexible repayment options. For urgent needs, our lending app also offers instant loans and cash advances to ensure you’re never caught off guard instantly.

Why Choose Instant Cash for Credit Card and Payday Advance?

Instacash is not just a payday borrowing lending app; it’s a financial marketplace designed to connect you instantly with payday credit card offers and instant loan options. With us, you can find the perfect balance between long-term financial flexibility and immediate cash flow solutions. Our app ensures you can easily compare and apply for payday credit cards tailored to your needs instantly.

Borrow Money Instantly with Instant Loan:

- Find Credit Cards Quickly: Compare credit card offers, including low-interest cards, cashback programs, and cards with no annual fees.

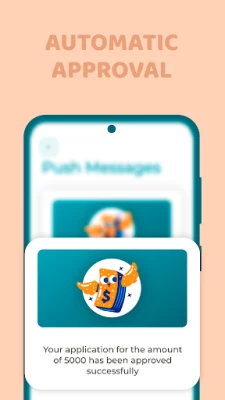

- Instant Loan Options: Borrow quick loans or payday cash advances when you need them most.

- Credit Card Management: Use our app to track, manage, and optimize your credit card spending.

- Secure Transactions: All applications and transactions are encrypted, ensuring your data is protected.

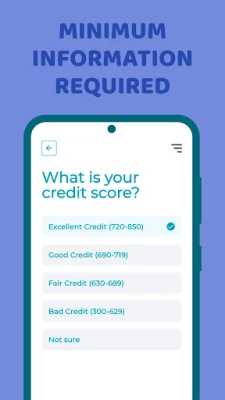

- Tailored Recommendations: Get personalized instant suggestions for credit cards or loans based on your preferences and financial profile.

Take control of your finances now! Download Instacash to borrow money, fast credit card deals and apply for loans instantly. Build financial flexibility with insta tools designed for you and get a payadvance loan!

Loan Conditions:

The minimum loan repayment period is 92 days;The maximum loan repayment period is 365 days.The maximum annual interest rate, including loan interest, as well as all other annual fees and expenses (Annual Percentage Rate) is 32%, and the minimum is 1%. Annual interest for use of the loan - minimum 1%, maximum 32%.Daily loan rate is between 0.01% and 1%.Late fee: 0.1%/day, max 10% of the total loan.No other charges; data may be sent to Credit Bureau for long-term delay.Loan extension is possible with interest payment for the initial term. A representative loan example:Loan: Amount $1000; term - 3 months.APR - 32%Your monthly repayment is $351,27.The total amount payable is $1053,81.The total interest is $53,81.Consequences of delayed loan repayment:In case of non-compliance with the payment terms of the online loan, the client may be charged 0.1% of the total amount for each day of delay, but not more than 10% of the total loan amount.Requirements for borrowers:Age: between 18 and 65 years.

Do you need flexibility to manage unexpected expenses or a reliable way to build credit instantly? Instacash provides money to compare and apply for credit cards with features like cashback, low interest rates, and flexible repayment options. For urgent needs, our lending app also offers instant loans and cash advances to ensure you’re never caught off guard instantly.

Why Choose Instant Cash for Credit Card and Payday Advance?

Instacash is not just a payday borrowing lending app; it’s a financial marketplace designed to connect you instantly with payday credit card offers and instant loan options. With us, you can find the perfect balance between long-term financial flexibility and immediate cash flow solutions. Our app ensures you can easily compare and apply for payday credit cards tailored to your needs instantly.

Borrow Money Instantly with Instant Loan:

- Find Credit Cards Quickly: Compare credit card offers, including low-interest cards, cashback programs, and cards with no annual fees.

- Instant Loan Options: Borrow quick loans or payday cash advances when you need them most.

- Credit Card Management: Use our app to track, manage, and optimize your credit card spending.

- Secure Transactions: All applications and transactions are encrypted, ensuring your data is protected.

- Tailored Recommendations: Get personalized instant suggestions for credit cards or loans based on your preferences and financial profile.

Take control of your finances now! Download Instacash to borrow money, fast credit card deals and apply for loans instantly. Build financial flexibility with insta tools designed for you and get a payadvance loan!

Loan Conditions:

The minimum loan repayment period is 92 days;The maximum loan repayment period is 365 days.The maximum annual interest rate, including loan interest, as well as all other annual fees and expenses (Annual Percentage Rate) is 32%, and the minimum is 1%. Annual interest for use of the loan - minimum 1%, maximum 32%.Daily loan rate is between 0.01% and 1%.Late fee: 0.1%/day, max 10% of the total loan.No other charges; data may be sent to Credit Bureau for long-term delay.Loan extension is possible with interest payment for the initial term. A representative loan example:Loan: Amount $1000; term - 3 months.APR - 32%Your monthly repayment is $351,27.The total amount payable is $1053,81.The total interest is $53,81.Consequences of delayed loan repayment:In case of non-compliance with the payment terms of the online loan, the client may be charged 0.1% of the total amount for each day of delay, but not more than 10% of the total loan amount.Requirements for borrowers:Age: between 18 and 65 years.

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

Peacock TV: Stream TV & MoviesPeacock TV LLC

Mr.Billion: Idle Rich TycoonIDSIGames

WPS Office-PDF,Word,Sheet,PPTWPS SOFTWARE PTE. LTD.

Ludo King®Gametion

TCG Card Store Simulator 3DBlingames

FatsomaFatsoma Android

Statastic Basketball TrackerStatastic Solutions FlexCo

RealVNC Viewer: Remote DesktopRealVNC Limited

Gooka: Unlimited AI ChatALWAYS WITH YOU LLC.

Truth or Dare Game - OweeOwee

More »

Editor's Choice

Grim Soul: Dark Survival RPGBrickworks Games Ltd

Craft of Survival - Gladiators101XP LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : WastelandStickyHands Inc.

AoD Vikings: Valhalla GameRoboBot Studio

Viking Clan: RagnarokKano Games

Vikings: War of ClansPlarium LLC

Asphalt 9: LegendsGameloft SE

Modern Tanks: War Tank GamesXDEVS LTD